Top 5 Must-Have Tax Deductions for Real Estate Agents (2022)

Setting your finances in order as a Real Estate Professional can be both time-consuming and energy-draining. Don't postpone the important step of organizing your business expenses, or you'll be faced with a higher tax bill and potential disaster during tax season. To help you make the most of deductions come tax time, here are 5 essential tax deductions that you can claim as a Real Estate Agent or Broker for 2022.

Note: We are not tax professionals and we recommend that you consult one for your personal taxes.

#1 Marketing and Marketing Materials

If you’re a modern business owner, you likely spend money to promote your brand through print and digital/online advertising. Advertising-related expenses like materials, signs, ad spend, and photography to stage your listings will all be deductible through the advertising deduction. This particular deduction is so broad that it can be a great money-saver for Real Estate Agents and Brokers come tax time.

WANT TO ELEVATE YOUR PERSONAL BRAND? CHECK OUT THESE CUSTOMIZABLE TEMPLATES >>>

#2 Business Meals

When traveling on business and/or dining out with clients, you can deduct up to 50% of the total expense (2022 is the last time dining can be deducted at 100% – check with your accountant). It's important to keep track of these expenses as they can add up quickly.

For 2021 and 2022, the IRS is allowing the full deduction of food and drinks purchased from restaurants for business purposes. However, entertainment expenses are no longer deductible, with the exception of when they're given as gifts.

#3 Office Supplies / Printed Marketing

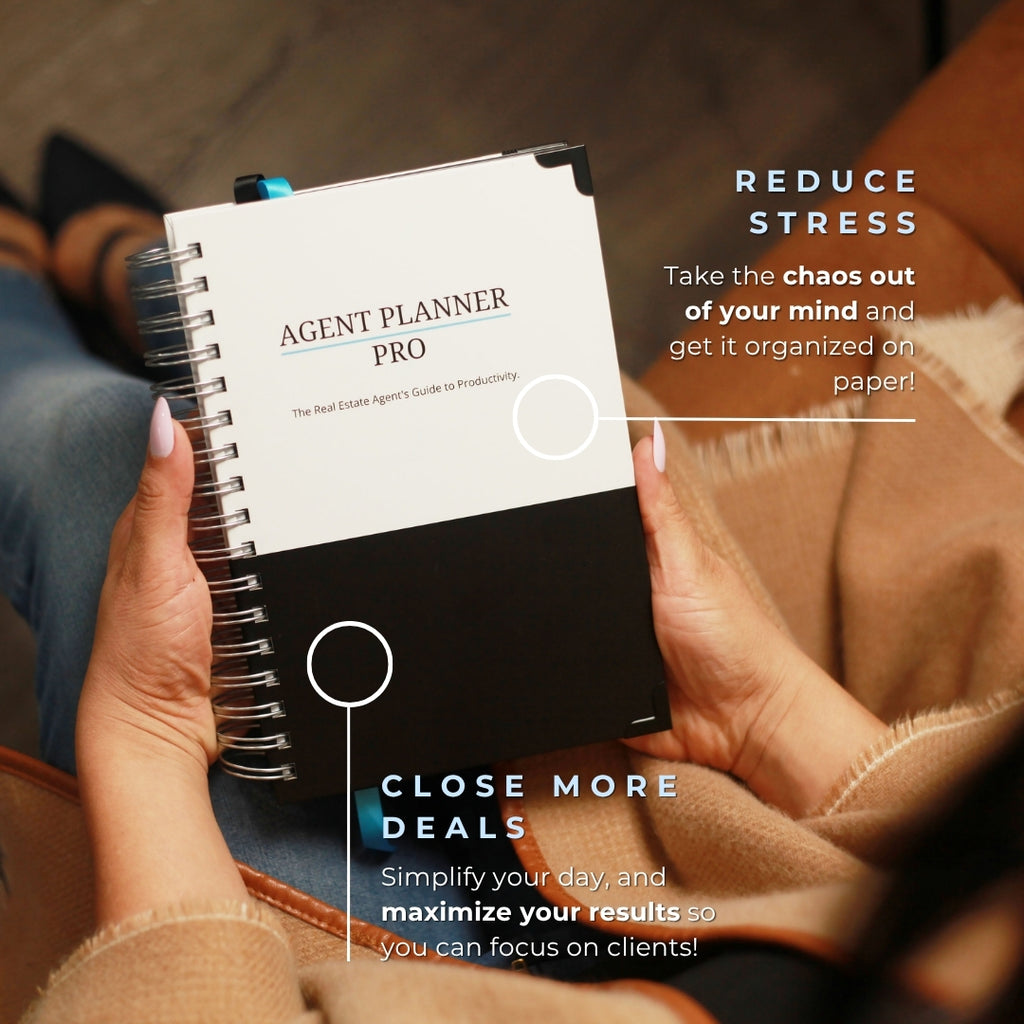

Office supplies such as Printed Materials, Business Cards, Flyers, Planners, and Signage are tax-deductible expenses. Major purchases like furniture, computers, and phone systems (for your business) can either be fully expensed the year it is purchased or be depreciated over a given period.* Make sure to research and document your financial records thoroughly if you choose the depreciation route.

#4 Car Depreciation and Mileage

Every mile driven for your real estate business is eligible for a potential tax deduction. The IRS reimbursement rate for 2021 is currently set at 62.5 cents per mile. Your accountant or tax professional can tell you what the 2022 rate is.

Automate mileage tracking with a mileage tracker app like Everlance to save time, energy, and money. If you drive over 10,000 miles in a year for your real estate business, the standard mileage deduction is likely the best option for you.

If you drive fewer miles or have a high car payment, the actual cost method may be the most beneficial.

#5 Education and Training

If you invest in continuing education or training courses to stay competitive in the field of real estate, you may qualify for certain deductions. The IRS requires that the courses are related to your current profession, do not meet minimum education requirements of the profession, and serve the purpose of improving or maintaining your skill in the field.

Should all of these criteria be met, you can deduct expenses such as course fees, tuition, books and supplies, lab costs, transportation, and more.

If you're approaching the end of the year it might be a good idea to book next year's Tony Robbins conference now.

WANT 100+ HOURS OF FREE EDUCATION FOR REAL ESTATE AGENTS CLICK HERE >>>

Real estate professionals have the opportunity to take advantage of many different tax deductions that can be beneficial come tax time. Keeping accurate records of expenses throughout the year, and investing in helpful apps can make the process easier. There are additional deductions that can be taken. Speak to your accountant to further your knowledge on the subject and stay up to date with the tax law.

There is nothing wrong with taking full advantage of these deductions, Realtors can reduce their taxes and maximize their savings. Keep closing deals and building that book of business! See you in 2023.

Get Organized with These ⭐️⭐️⭐️⭐️⭐️ 5-Star Rated Favorites

Shop Agent & Broker Favorites

The Complete Agent Presentation Bundle - Minimalist

$46.95

Instant Access & Customizable!

Real Estate Agent Business Plan BluePrint [DIGITAL DOWNLOAD]

$39.95

Instant Access PLUS Course!

Become a Better Real Estate Marketer One Monday at a Time with Marketing Mondays! Sign Up Now!